is the interest i paid on my car loan tax deductible

If a personal loan is being used for mixed purposes like a car loan with the car split between business and personal use then the portion of the interest thats deductible is proportional. However an exception applies to points paid on a principal residence see Topic No.

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

When you prepay interest you must allocate the interest over the tax years to which the interest applies.

. Self-employed workers report motor vehicle expenses on the T2125 Statement of Business or Professional Activities form. However if you are buying a car for commercial use you can show the interest paid. If the vehicle is entirely for personal use.

You might pay at least one type of interest thats tax-deductible. However some people believe that it is possible for interest charged on excess of loan principal to be deducted as well. On the condition that you have a business car or you use your personal vehicle for business purposes you may be eligible to deduct car loan interest parking fees and tolls and personal property tax.

The expense method or the standard mileage deduction when you file your taxes. So being able to deduct the interest on your taxes can help reduce the overall cost of ownership. 10 x the number of days for which interest was payable.

But there is one exception to this rule. The standard mileage rate already factors in costs like gas taxes and insurance. Are tax-deductible for the borrower.

Car loan interest is tax deductible if its a business vehicle You cannot deduct the actual car operating costs if you choose the standard mileage rate. But you cant just subtract this interest from your earnings and pay tax on the remaining amount. Therefore the quick and easy answer to the question is no However some other loan-related expenses are deductible so dont stop at auto loans when searching for deductions.

You must report your tax-deductible interest to the IRS and this invariably means filing additional. If you use your car for business purposes you may be able to deduct actual vehicle expenses. This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction.

But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file. Include the interest as an expense when you calculate your allowable motor vehicle expenses. The same rule applies to car loans.

If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does not reduce your tax. Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently. You can deduct the interest paid on an auto loan as a business expense using one of two methods.

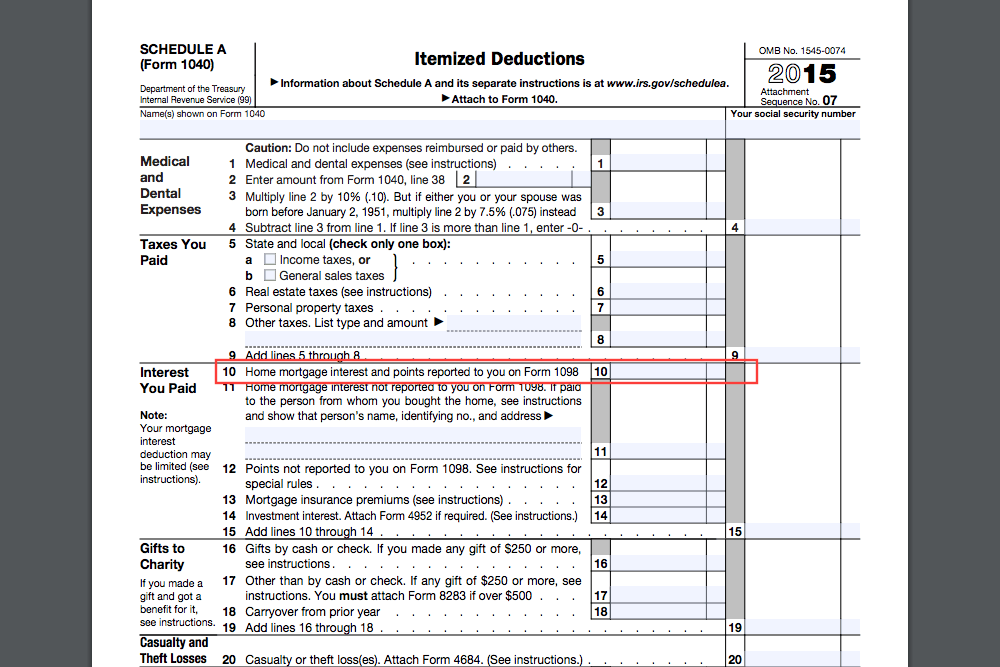

There may be times you can claim irs car tax deductions for interest paid on a car loan to help lower the amount of federal taxes you owe. In this case neither the business portion nor the personal portion of the interest will be deductible. Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your homethe phrase is buy build or substantially improve.

Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest. For vehicles purchased between December 31 1996 and January 1 2001 only. Interest paid on personal loans is not tax deductible.

You cant even deduct depreciation from your business car because thats also factored in. Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it is not deductible for personal use. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense.

Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income. A margin loan is a loan to purchase stock on margin. In many cases the interest you pay on personal loans is not tax deductible.

Tax benefits on Car Loans. In addition interest paid on a loan thats used to purchase a car solely for persona. You can deduct interest on the money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or a zero-emission passenger vehicle you use to earn business professional farming or fishing income.

If you are an employee of someone elses business you are not eligible to claim this deduction. The personal portion of the interest will not be deductible. The IRS has a policy that says that only interest paid by a taxpayer on loans bonds notes debentures etc.

What Do Banks Look for. Typically deducting car loan interest is not allowed. Should you use your car for work and youre an employee you cant write off any of the interest you pay on your auto loan.

While typically deducting car loan interest is not allowed there is one exception to this rule. Car loan interest can add thousands of dollars to the price of a new car or truck. During Ronald Reagans time in office he reformed tax laws so that auto loan interest can no longer be tax deductible.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. To deduct interest on passenger vehicle loans take the lesser amount of either. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

You cannot deduct a personal car loan or its interest. If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized deduction. You may deduct in each year only the interest that applies to that year.

If youâre still unsure whether you qualify keep reading to see how car loan interest gets factored into your tax deduction. According to HR Block interest is non-deductible when the vehicle is used for personal reasons but at least partially deductible when operated in the line of business. Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use.

If you use your car for business purposes you may be able to deduct actual vehicle expenses. However you may be able to take a tax deduction if you use the loan for certain specific purposes and meet all the eligibility requirements. Unfortunately car loan interest isnt deductible for all taxpayers.

View solution in original post 0 Reply 1 Reply Marketstar Level 7 June 7 2019 301 PM.

Is Line Of Credit Interest Tax Deductible In Canada Ictsd Org

Are Business Loans A Tax Deductible Liability Loans Canada

The Amount Of Interest Paid Is Eligible For Deduction And Moreover There Is No Cap On The Amount To Be Deducted You Can Income Tax Saving Education Income Tax

Quickbooks Self Employed Review 2022 Carefulcents Com Quickbooks Small Business Accounting Online Taxes

Is Car Loan Interest Tax Deductible In Canada

House Property Income Tax Refund

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Quickstudy Finance Laminated Reference Guide Tax Prep Checklist Small Business Tax Tax Prep

Want To Increase Your Take Home Salary Or Maximize Your Tax Saving Simple And Easy Infographic Use This Form 12bb Generator To De Filing Taxes Investing Form

10 Brilliant Budget Trackers For Your Bullet Journal Bullet Journal Budget Money Makeover Finance Bullet Journal

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

Car Loan Tax Benefits On Car Loan How To Claim Youtube

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

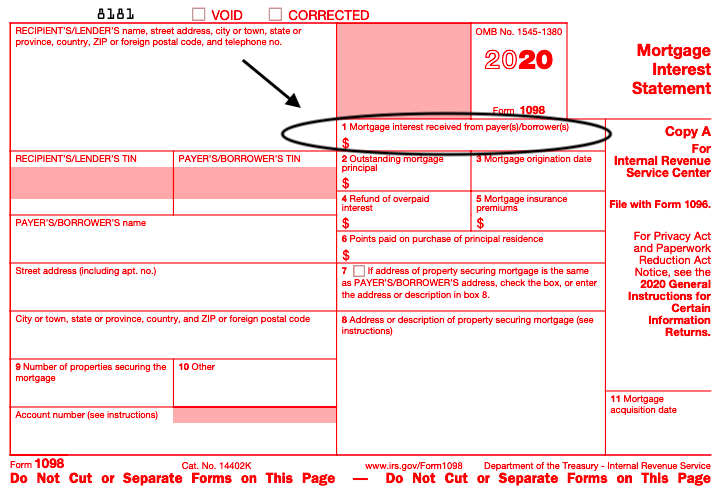

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement Definition

Publication 530 2014 Tax Information For Homeowners Business Budget Template Tax Deductions Spreadsheet Template Business